The annual rate of global inflation fell to 3.5% in July, down from 3.8% in June, which will be welcomed by the Reserve Bank.

But economists say the slowdown in the pace of inflation last month was largely expected and will not encourage the RBA to cut interest rates anytime soon.

According to the Australian Bureau of Statistics’ (ABS) monthly inflation indicator, an important measure of core inflation – called “average inflation” – also fell in July.

It fell to 3.8%, down from 4.1% in June.

The RBA wants this measure of core inflation to continue falling, with the aim of reaching 2.5%. But this is not forecast until late 2026 or early 2027.

Leigh Merrington, ABS acting head of price statistics, said the biggest contributors to inflation in July were housing (+4 per cent), food and non-alcoholic drinks (+3.8 per cent), alcohol and tobacco (+7 .2 percent). , and transportation (+3.4 percent).

But she said the introduction of electricity rebates had contributed to a significant drop in energy prices last month.

“The first tranches of Commonwealth Energy Bill Relief Fund cuts for 2024-25 started in Queensland and Western Australia from July 2024, with other states and territories to follow from August,” she said.

“Additionally, state-specific reductions have been introduced in Western Australia, Queensland and Tasmania.

“In total, these cuts led to a 6.4% drop in July. Excluding cuts, electricity prices would have risen 0.9% in July,” she said.

Lower electricity prices

The drop in electricity prices was substantial last month.

Electricity prices rose at an annual rate of 7.5% in June, but fell sharply to -5.1% in July.

Treasurer Jim Chalmers said the ABS data showed inflation would have been higher without the government’s “responsible cost of living help”.

“Rents rose by 6.9% in the year to July, but without the biggest increase in Rent Support in 30 years, they would have risen by 8.8%,” he said.

“Electricity prices fell 5.1% in the year to July, which is more than they would have fallen without the energy cut we’re rolling out with the states.

“Without our cuts, they would have fallen by 2.3% in the year to July,” he said.

But economists warned that the monthly inflation data should be read with caution due to electricity cuts.

“CPI is becoming increasingly difficult to decipher as temporary measures to reduce the cost of living artificially push up inflation numbers, obscuring evidence of lower price pressures in the economy,” EY senior economist Paula Gadsby said in a note.

“The Reserve Bank will need further evidence from future monthly inflation data and more comprehensive quarterly CPI prints to convince itself that price pressures are easing.

“Our central expectation remains that the Reserve Bank will keep the cash rate tight for the remainder of the year,” she said.

Coles and Woolworths in the limelight

The inflation data comes as Australian supermarket giants Coles and Woolworths released their full-year profit results this week, just months after facing a Senate inquiry into food prices.

After outrage over last year’s profit results – which prompted a series of inquiries – the big supermarkets are facing increased scrutiny from consumers, politicians and consumer watchdogs worried about a lack of competition in the sector.

They were accused of price gouging and engaging in unfair practices with suppliers.

On Wednesday morning, Woolworths reported group sales growth of 5.6% for 2024, but a huge 93.3% drop in profit after tax (after significant items) to $108 million.

The lower profit result was hit by two major write-downs, the biggest of which was a $1.5 billion write-down of its New Zealand grocery business.

Woolworths explained that its NZ business “continues to be significantly impacted by higher wage costs and a value-conscious customer in a highly competitive market”.

It also mentioned a previously reported reduction in its stake in ASX-listed alcohol and hotels spin-off Endeavor, which owns bottle shop chains BWS and Dan Murphy’s.

Excluding these costs, Woolworths posted a 0.6% drop in full-year profit to $1.7 billion.

It said its Australian grocery sales rose 5.6 per cent in the financial year to $50.7 billion, while BigW sales fell 2.1 per cent to $4.6 billion. dollars.

On Tuesday, Coles reported that its profit was higher for the year.

It saw an 8.3% increase in its statutory net profit after tax to $1.1 billion for the 2024 financial year.

Coles chief executive Leah Weckert said the results were driven by more Australians choosing to have a meal at home instead of dining out during a cost of living crisis.

Problems with monthly inflation data

But back to inflation.

The artificial fall in electricity prices in July is not the only complicating factor facing analysts.

Earlier this month, Reserve Bank Governor Michele Bullock warned that people should not take too much “signal” from the monthly ABS inflation gauge anyway.

She said quarterly ABS inflation data was of better quality and more comprehensive.

Her comments targeted a recent controversy surrounding the monthly inflation gauge.

A few months ago, the indicator seemed to suggest that inflation was higher again, prompting some analysts to put serious pressure on the RBA to raise interest rates further.

But then when new full quarterly inflation figures came out, they showed that core inflation actually fell in the June quarter, and core inflation has been falling since the December 2022 quarter.

“We’ve always been a bit wary of monthly CPI,” Ms Bullock said of the controversy.

“I got a signal from the monthly CPI, [but] I think it’s fair to say that taking too much of a cue from it, as some people have, has turned out to give people a bit of a misdirection as to how high inflation is. [rate] it could be,” she said.

On Wednesday, EY senior economist Paula Gadsby said the latest monthly inflation figures for July also had another problem.

“The data should be read with some caution as the first month of the quarter focuses on prices of durable goods such as clothing and household goods rather than services and domestic factors,” she said.

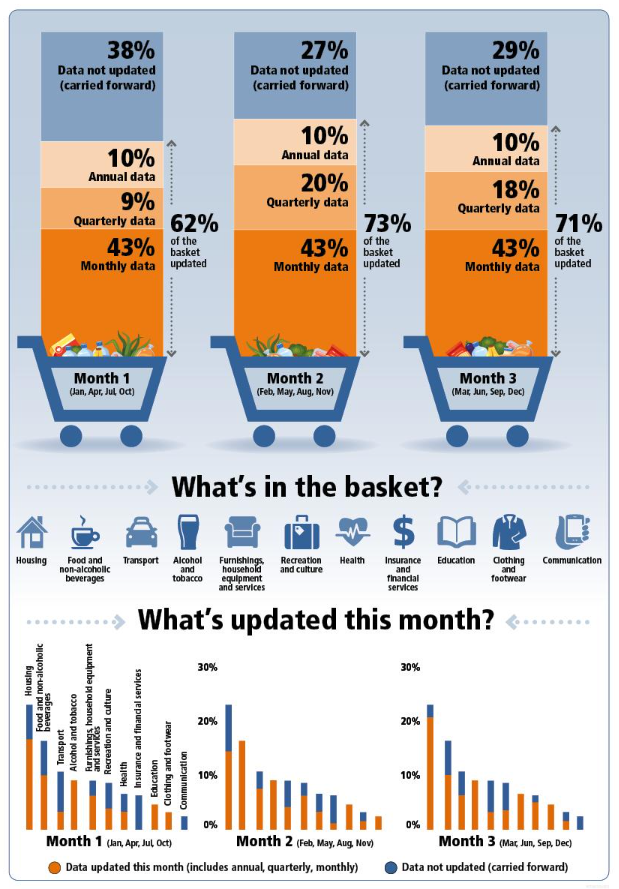

The chart below shows what this means.

According to the methodology, the monthly ABS inflation gauge only updates prices for between 62% and 73% of the CPI basket each month, depending on the month.

It divides the year into quarters, with three months in each quarter.

July is classified as “Month 1” because it is the first month of the new quarter.

But the first month of the quarter focuses on commodity prices rather than services and domestic drivers, as Ms Gadbsy points out.

And unfortunately services inflation is more problematic than goods inflation right now.

However, Westpac senior economist Pat Bustamante said there were still some positive signs in July’s figures.

“Some of the items updated only in the first month of the quarter show clear signs of disinflation, including clothing and footwear and household items, which came in softer than we expected,” he said.

“Compared to Westpac’s forecasts, energy and food came in more than expected. [But] this was partially offset by lower clothing and footwear, household goods and recreational services.”

#Inflation #eases #July #energy #cuts #electricity #prices